Written by:

One of the most impactful decisions an individual or family can make is creating a written financial plan. But ultimately, even the most fundamentally sound financial plans can be thrown off by one mistake. Steering clear of these five mishaps will help ensure you stay on track.

1. Investing Money Into Equities That You’ll Need In The Short-Term

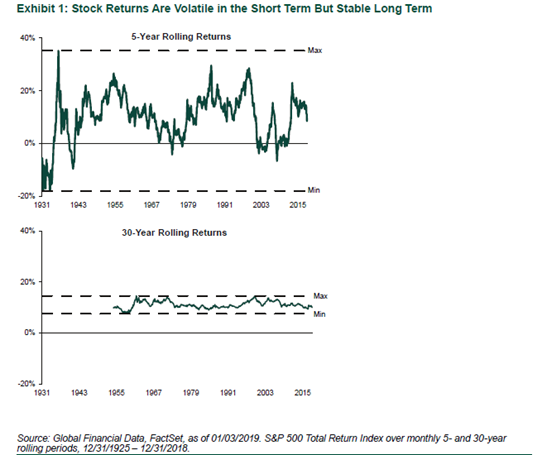

A common mistake investors can make is leaving money invested in equity markets when the time horizon for using said funds is short. Whether it be saving for a child’s upcoming education or approaching a desired retirement age, keeping the time horizon front-of-mind for funds that are invested is of paramount importance. The below exhibit shows 5-Year Rolling Returns of the S&P 500 Index compared with 30-Year Rolling Returns of the S&P 500 index between the years 1931-2015. Five year rolling returns from this time period have shown to be volatile. There were certain five year windows within that timeframe in which an investor would have experienced a loss in their investment. However, if we extrapolate out to a thirty-year window, there was no thirty-year timeframe between 1931-2015 where that same investor would have experienced a loss in the S&P 500 index.

Ultimately, a general rule of thumb is to keep money you plan on using in the next five years outside of the equity markets. Ensuring that your investment allocations match the time horizons for each of your financial goals can help keep your financial plan on a better track.

On the flip side, all money outside of 5 year timeframe, we recommend to invest in equities once you have your short term horizon planned for appropriately.

2. Letting Emotions Dictate Investment Decisions

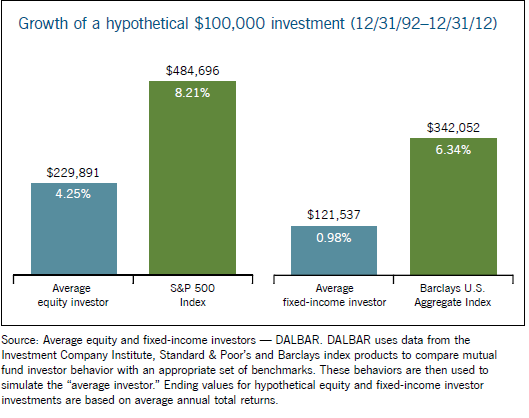

One of the keys to a sustained, long-term investment strategy is to be an unemotional investor. Whether it is easy to admit or not, oftentimes emotions outweigh logic when making investment decisions. The below graphic shows the growth of a hypothetical $100,000 investment from December of 1992 to December of 2012, in the S&P 500 Index and Barclays Index. Had an investor just kept their $100,000 in the S&P 500 for the twenty year period, reinvested dividends, and didn’t take any withdrawals, the investor would have received an 8.21% return. However, the average investor in the equity markets over that same time period only averaged 4.25% due to pulling in and out of the market because of news and ultimately fear that caused emotional decision making. Investing with too much emotion can lead to pulling money out of the equity markets when they are down (when it feels good to be on the sidelines) and putting money back into the equity markets when they rise.

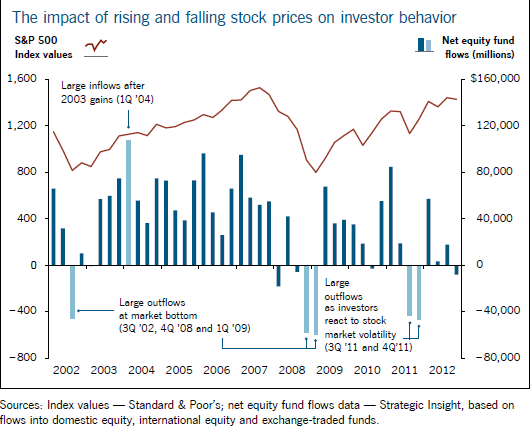

Further extrapolating, the below graph displays when large inflows and outflows from the stock market occurred between the years 2002 – 2012.

As shown, large outflows (the light blue line downward) occurred in 2008 and early 2009, as investors reacted to severe volatility. Large inflows (the dark blue line upwards) then occurred after market recovery in late 2009 and 2010.

Avoiding emotional decisions and sticking with your financial plan through short-term volatility can pay huge dividends towards achieving your financial goals.

3. Being Too Concentrated In One Investment or Sector

Having “too many eggs in one basket” with regard to your investment strategy can be a detriment to a sound financial plan. This is particularly relevant for highly compensated executives who hold company stock. Generally speaking, we advise keeping a position under 10% of your overall balance sheet. In certain scenarios, between 401k balances and large company stock positions, an executive could have upwards of 50% of their net worth tied to one company’s performance, not even including the company providing them their salary and potential benefits. If the company suffers distress, this could put a strain on the executive’s financial plan.

This idea doesn’t just apply to executives. Many investors will hold onto a position that is overweight for sentimental or emotional reasons. As stated previously, letting emotions dictate investment decisions can have consequences. Ultimately, keeping an asset allocated, diversified portfolio paired with unemotional behavior is generally advisable.

Here is a story of an EWA client who saved millions by following this exact advice.

4. Not Adjusting To Your “Money Temperature”

Without even realizing it, it is very easy to seemingly adjust to an increased income by increasing expenses and not adjusting to your “money temperature”. What is also referred to as “lifestyle creep,” this is the idea of former luxuries becoming new necessities to correspond with a rising discretionary income.

If this is not planned for in a deliberate manner, one can feel like they are living paycheck to paycheck despite earning more income. The best way to adjust to an increased money temperature is to develop the correct system for saving and spending on a monthly basis. Employing a “reverse budgeting” system aims to divide expenses on a monthly basis into a fixed category and a variable category. If fixed expenses (debt payments, bills, savings) are on autopilot and paid each month, the remaining pay can be sent to the “variable category,” and is meant to be spent down to $0 guilt-free each month. With these guardrails in place, one is much better able to adjust to their money temperature and ensure a better path towards financial success.

5. Not Having A Drafted Estate Plan

According to a Caring.com survey, only one-third of Americans have a documented estate plan in place. While some may believe estate planning is only for the ultra-high net worth, every family can benefit from having even basic estate planning documents in place, namely wills and powers of attorney. Wills help dictate what happens to your assets when you pass (if they do not have direct beneficiaries already attached), and powers of attorney allow you to choose who will make medical and financial decisions on your behalf if you are incapacitated. If these documents aren’t in place, the courts will decide how your assets are split (if beneficiaries are not already named directly), which may or may not fall in line with your ultimate wishes. If assets are further subject to probate, then this process of settling the estate is technically public record and can be accessed by anyone. Furthermore, if a situation involves trust planning, be it revocable, irrevocable, or special needs, then further discussion to ensure proper settling of assets will be required.

No investment strategy is completely bulletproof, but avoiding these five mistakes can help lead to a sustained, long-term financial plan. If you have questions about any of the above topics, please consult with a financial advisor and / or estate planning attorney.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.

EWA, LLC dba Equilibrium Wealth Advisors, is an SEC-registered investment advisory firm providing investment advisory and financial planning services to clients.

Investments in securities and insurance products are not insured by any state or federal agency.

To view EWA’s public disclosure, registration, Form ADV and Part 2B’s, click here.

To view EWA’s Client Relationship Summary (CRS), click here.

COPYRIGHT 2024 EWA, LLC. ALL RIGHTS RESERVED

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.