Written by:

The standing room temperature of a household is frequently a point of contention. However, whether you prefer the temperature on the cooler side or warmer side, once a number is set on the thermostat, you’ll soon adjust to that specific temperature in the room.

Budgeting on a monthly basis is a very similar analogy. If there is not a set system in place, it is very easy to seemingly adjust to your monthly income and lose track as to how much is saved versus spent each month. Because of this phenomenon, one of the most important steps one can take towards owning their finances is creating a proper budget. However, those that meticulously track expenses and worry about how much they spend, often stay behind without a set budgeting system in place.

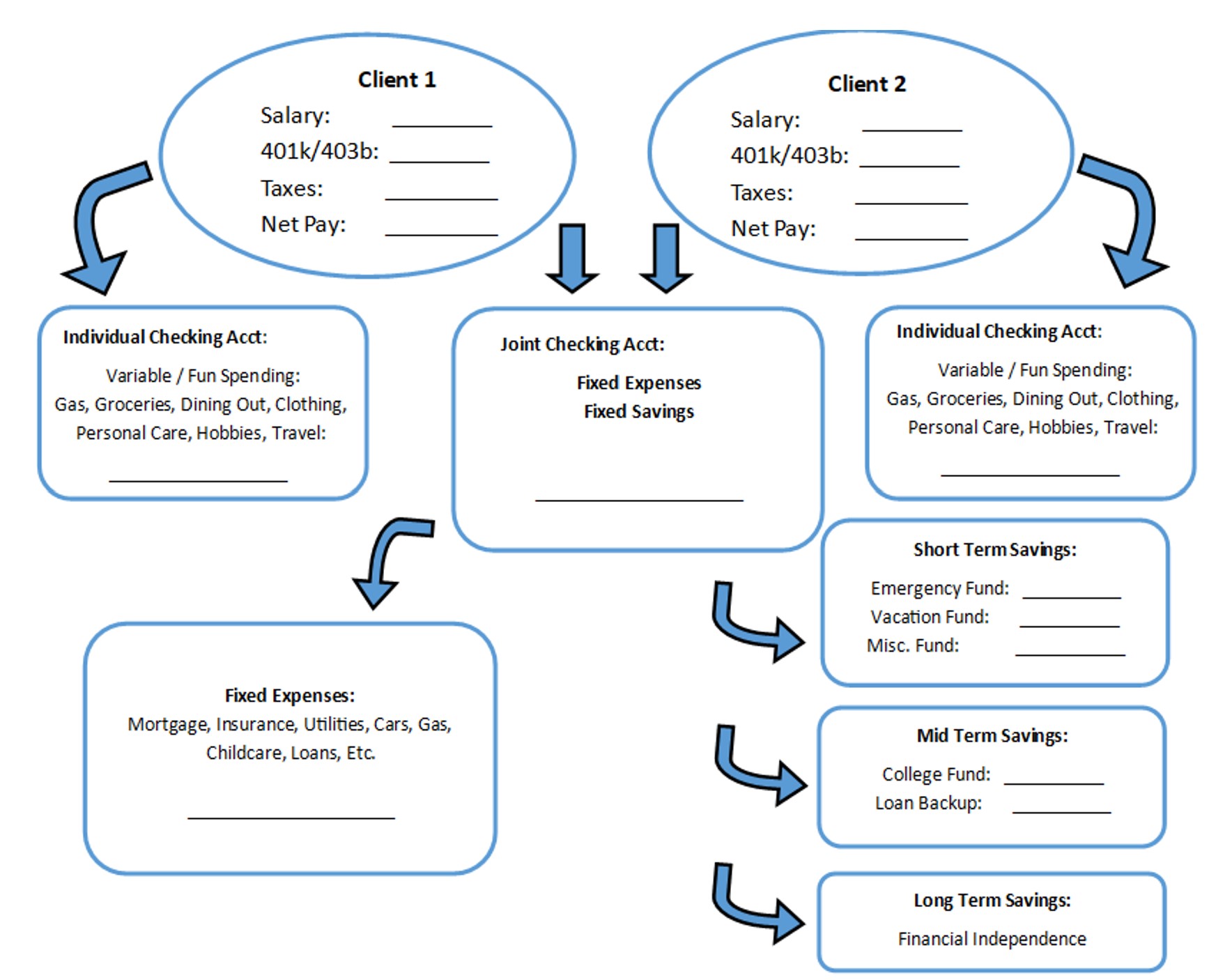

While there are many ways one can budget, one system that we have found to be most productive is the concept of “reverse budgeting.” In the simplest terms, reverse budgeting breaks down your monthly income into two buckets: one being fixed expenses and the other variable expenses, and then automating and prioritizing savings (just like you must pay your mortgage, you must pay yourself, “save,” if you want to get ahead).

Fixed expenses are payments that need to be satisfied on a monthly basis. Examples of fixed expenses include mortgage payments, insurance premiums, utilities, student loan payments, etc. For this exercise, monthly savings are also included in the “fixed bucket.” Examples of this can include: 529 plan contributions, investment account contributions, Roth IRA contributions, etc.

Variable expenses are not fixed and can be different every month. Some examples of variable expenses include groceries, travel, dining out, and other discretionary spending.

The idea behind reverse budgeting is to have a portion of your income that fully satisfies the “fixed bucket” sent to a separate bank account (and set all bills and all savings on autopay). This is the key part to reduce decision fatigue. If this is not automated, we have seen the snooze button hit too many times for clients that intend to save but have not accomplished it. Feelings, moods, and short-term thinking can hijack the long-term plan.

The remaining portion of your income can be sent to your “variable bucket” bank account and can be spent down to $0 every month, knowing everything is satisfied from the fixed side of things.

For example, let’s assume a household earns a net monthly income (after taxes and 401k contributions) of $10,000. Furthermore, this household’s fixed expenses (including savings) are $7,000 and variable expenses are $3,000.

If properly implementing the reverse budgeting strategy, this household would have $7,000 of their monthly pay deposited into a bank account set strictly for fixed expenses. This satisfies all monthly savings and obligations, and essentially puts them on “auto-pilot” moving forward. The remaining $3,000 of pay would then be deposited into a second bank account. This allows this household to guilt-free spend down that $3,000 every month, knowing full well that they have already “paid themselves” and that their account will be replenished by their next pay.

We have found successfully implementing the reverse budgeting strategy helps eliminate “decision fatigue” and allows for easier spending decisions (knowing that all necessary obligations are on autopilot). While there are other budgeting systems that suffice, the reverse budgeting system doesn’t require tracking every expense on an Excel spreadsheet. Reverse budgeting allows efficiency and simplicity for an important aspect of your financial planning.

A proper budgeting system can help set you on the right path to spending within your means and working towards your financial goals.

__________________________________________________________________________________

Equilibrium Wealth Advisors is a registered investment advisor. The contents of this article are for educational purposes only and do not represent investment advice.

Stock markets are volatile, and the prices of equity securities fluctuate based on changes in a company’s financial condition and overall market and economic conditions. Although common stocks have historically generated higher average total returns than fixed-income securities over the long-term, common stocks also have experienced significantly more volatility in those returns and, in certain periods, have significantly underperformed relative to fixed-income securities. An adverse event, such as an unfavorable earnings report, may depress the value of a particular common stock held by the Fund. A common stock may also decline due to factors which affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.

Past performance is no guarantee of future results. The change in investment value reflects the appreciation or depreciation due to price changes, plus any distributions and income earned during the report period, less any transaction costs, sales charges, or fees. Gain/loss and holding period information may not reflect adjustments required for tax reporting purposes. You should verify such information when calculating reportable gain or loss.

This content has been prepared for general information purposes only and is intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an offer, invitation, investment advice or inducement to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any matter contained in this document. The tax and estate planning information provided is general in nature. It is provided for informational purposes only and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.

EWA, LLC dba Equilibrium Wealth Advisors, is an SEC-registered investment advisory firm providing investment advisory and financial planning services to clients.

Investments in securities and insurance products are not insured by any state or federal agency.

To view EWA’s public disclosure, registration, Form ADV and Part 2B’s, click here.

To view EWA’s Client Relationship Summary (CRS), click here.

COPYRIGHT 2024 EWA, LLC. ALL RIGHTS RESERVED

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.