Written by:

It’s tempting to try and time the market. After all, if you can predict when the market is going to go up or down, you can make a lot of money! Unfortunately, this is not something that Is feasible to do on a consistent basis and many studies have concluded that trying to time the market can actually be very harmful to your investment portfolio. In this blog post, we will discuss why it is better to invest for the long term and avoid the urge to ‘do something’ during times of volatility.

While it is nearly impossible to predict short-term market swings, in general and over long periods of time, the market has historically trended up. If we look at the data, history tells us that the US market (SP 500) is up about 75% of the time, and down about 25% of the time.

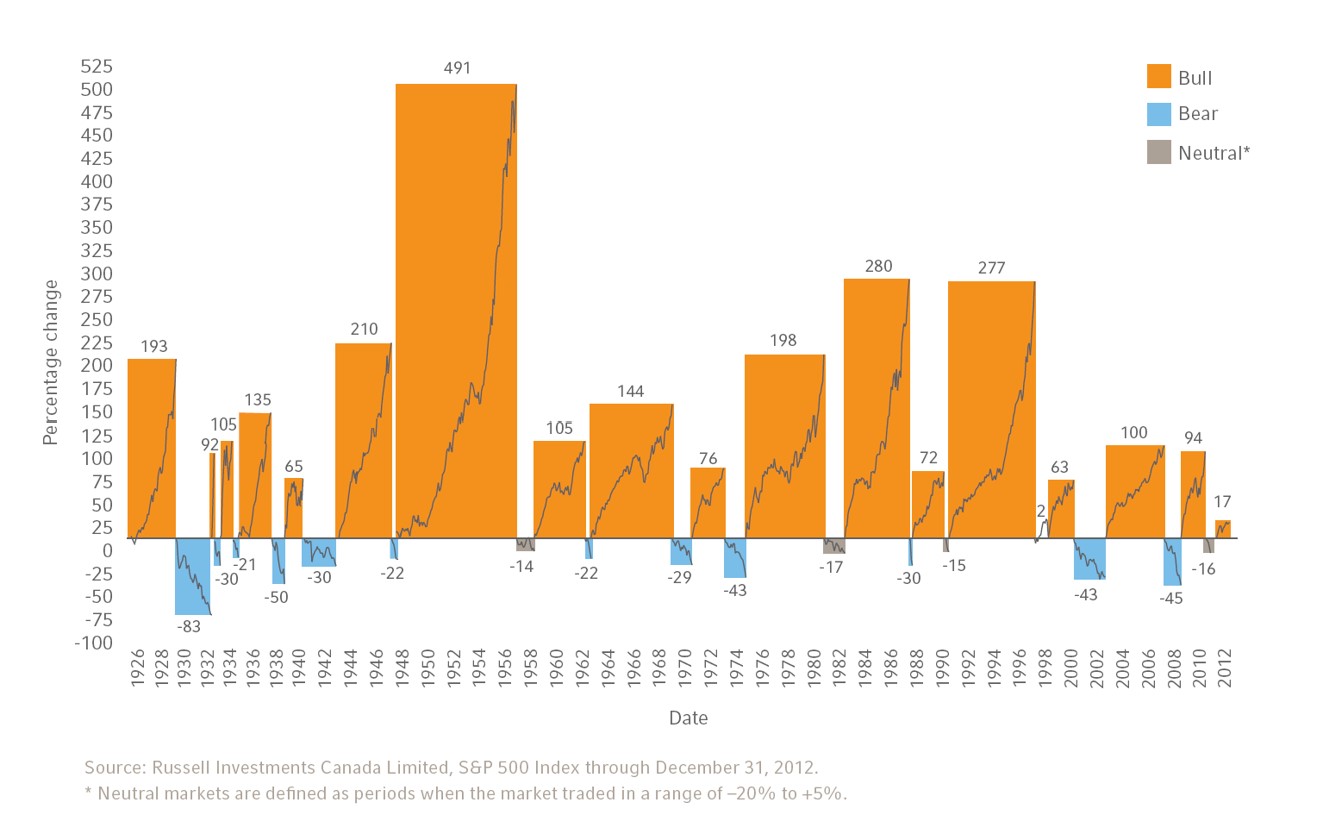

For example, the chart below looks at bull and bear markets in the United States (measured by the S&P 500 index) from 1926 – 2012:

A simple analogy is to think of the stock market like a casino. For example, imagine playing a game where you only win 25% of the time (pulling out or trying to “time the market”), vs being the house and winning 75% of the time. This is precisely how we approach investing because statistically, you should come out ahead by weathering short-term volatility and staying invested.

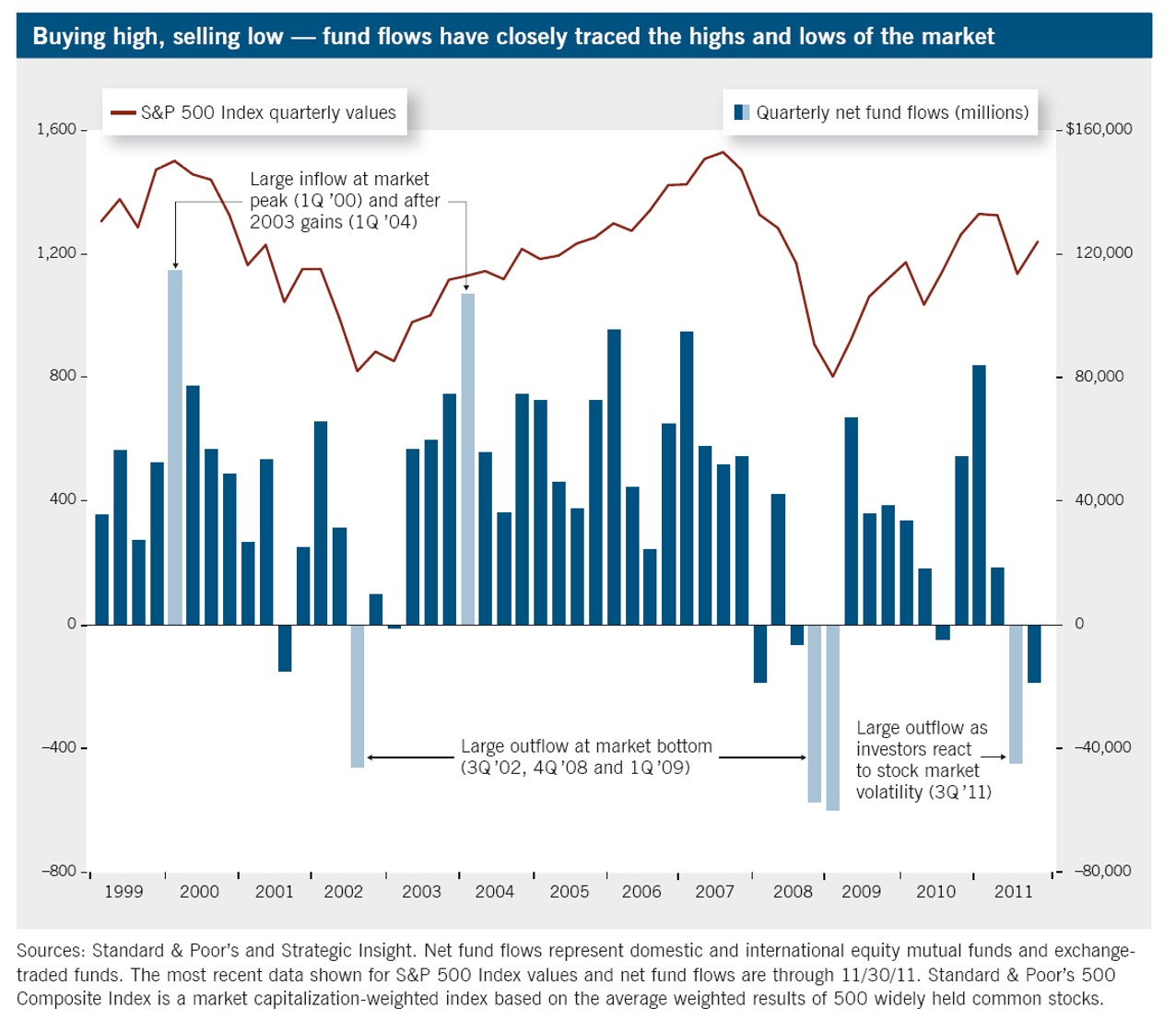

A study by DALBAR, a financial research firm, has shown how the general temptation for investors to try to time the stock market often results in the investor diving into the market at the top and fleeing at the bottom. For example, the chart below shows how market cycles influence inflow and outflows as investors react to volatility.

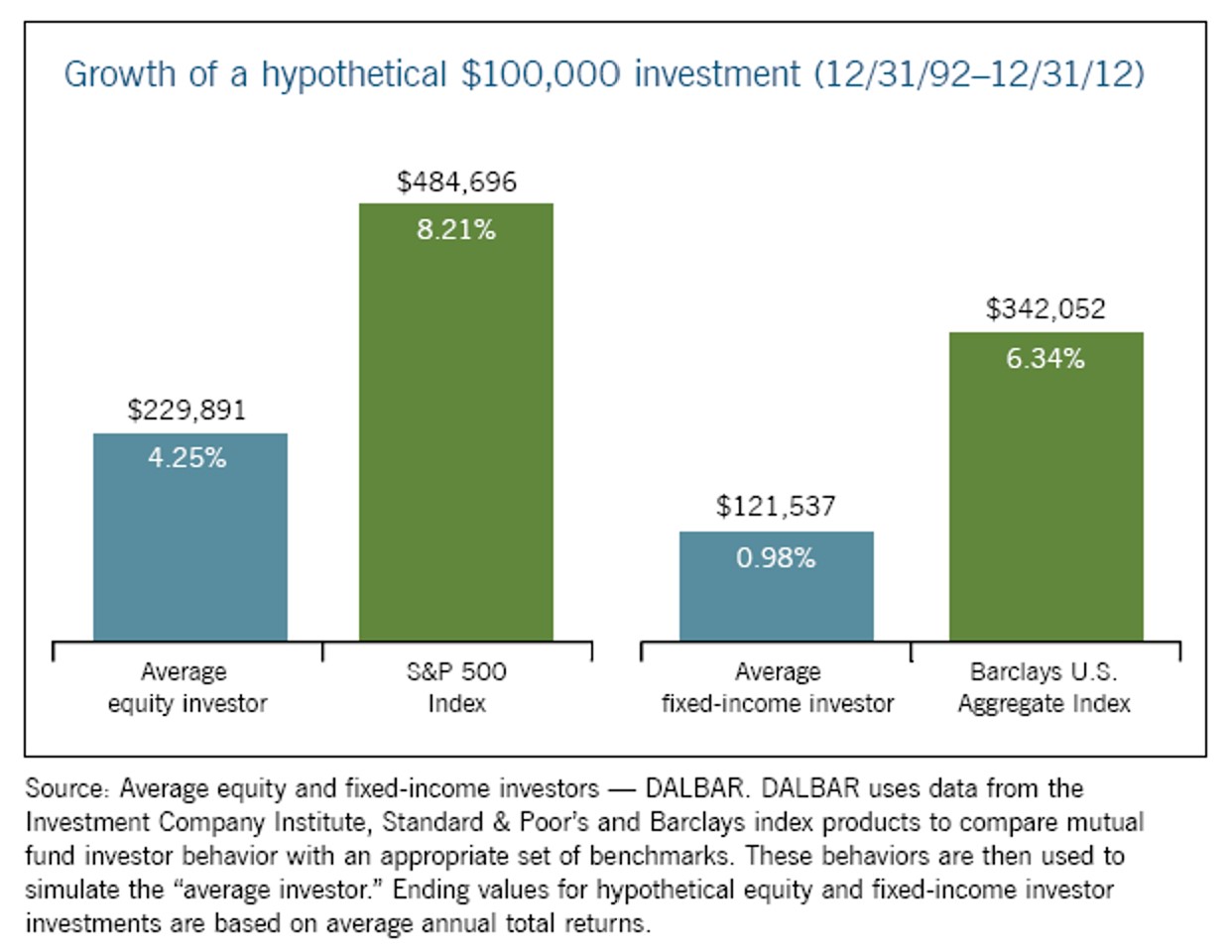

The following chart monetizes this mistake. If you had $100k invested over this 20-year period in the S&P 500, your ending balance would be $484,696, but the average equity investor investing in the same thing only ended at $229,891 in the same period and same starting investment because they tried to time in and out of the market.

In order to time the market, you have to be right twice-

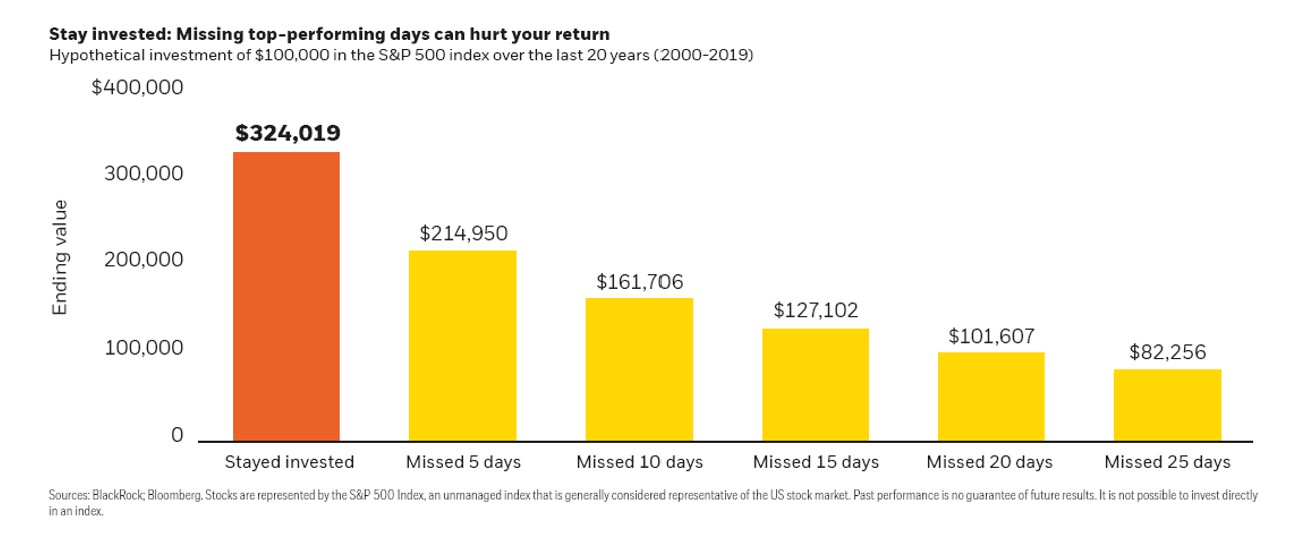

The following study demonstrates how risky this strategy can be for your portfolio. For example, if you have already sold out and you are waiting to buy back into the market, you could miss out on the market’s top-performing days. The following chart shows a hypothetical investment of $100k in the S&P 500 index from 2000 – 2019. As you can see, an individual who remained invested for the entire time period would have accumulated $324,019, while an investor who missed just five of the top-performing days (out of the 20-year period) would have accumulated only $214,950.

While successfully timing the market can lead to big gains in your portfolio, studies have shown that this is very difficult to do on a consistent basis over the life of a portfolio. The reality is, if you are in your working years, it is likely that you will see several downturns before you reach retirement and begin taking distributions. Rather than selling out of the market altogether during volatility, it is important to stick to a sound investment philosophy and stay disciplined to ensure your finances (and your portfolio) are working for you and supporting your life by design. If you have a sound investment mix and financial plan, you should never have to live life based on what the market is doing (or isn’t doing for that matter).

Here is a video resource from EWA describing the benefits of long-term investing: https://vimeo.com/manage/videos/658692896

Additional information on EWA’s investment philosophy can be found here: https://ewa-llc.com/blog/principles-to-follow-for-maximizing-your-investment-strategy/

______________________________________________________________________________

Equilibrium Wealth Advisors is a registered investment advisor. The contents of this article are for educational purposes only and do not represent investment advice.

Stock markets are volatile, and the prices of equity securities fluctuate based on changes in a company’s financial condition and overall market and economic conditions. Although common stocks have historically generated higher average total returns than fixed-income securities over the long-term, common stocks also have experienced significantly more volatility in those returns and, in certain periods, have significantly underperformed relative to fixed-income securities. An adverse event, such as an unfavorable earnings report, may depress the value of a particular common stock held by the Fund. A common stock may also decline due to factors which affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.

Past performance is no guarantee of future results. The change in investment value reflects the appreciation or depreciation due to price changes, plus any distributions and income earned during the report period, less any transaction costs, sales charges, or fees. Gain/loss and holding period information may not reflect adjustments required for tax reporting purposes. You should verify such information when calculating reportable gain or loss.

This content has been prepared for general information purposes only and is intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an offer, invitation, investment advice or inducement to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any matter contained in this document. The tax and estate planning information provided is general in nature. It is provided for informational purposes only and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.

EWA, LLC dba Equilibrium Wealth Advisors, is an SEC-registered investment advisory firm providing investment advisory and financial planning services to clients.

Investments in securities and insurance products are not insured by any state or federal agency.

To view EWA’s public disclosure, registration, Form ADV and Part 2B’s, click here.

To view EWA’s Client Relationship Summary (CRS), click here.

COPYRIGHT 2024 EWA, LLC. ALL RIGHTS RESERVED

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.