Written by:

Congratulations! You’ve done a great job investing and building your nest egg for retirement. You’ve made it to the end of your career and you’re now ready to enjoy some well-deserved free time with loved ones. Although there’s plenty to look forward to on the horizon, it’s important to ensure the proper planning is in place.

Monitoring the size, frequency, and timing of portfolio withdrawals in Retirement is of utmost importance. This is especially so in the early years of Retirement when withdrawing too much can potentially cause an irreparable drain on your portfolio (first ten to fifteen years). This is highlighted to an even greater degree when large and/or frequent distributions are made during a down market.

Becoming a disciplined, patient, long-term investor is an important part of wealth accumulation. Set up systematic savings and treat these contributions as “non-negotiable” in your ongoing budget. In doing so, you’ll be shocked at the power of compounding returns once Retirement is around the corner.

Once a calculated, comfortable financial plan is in place, it’s significantly easier to remove the emotional response to temporary market downturns. There’s comfort in knowing you’re on the right track to achieve your long-term goals.

The blind spot for most investors: Scaling the mountain tends to be less risky than the descent.

The sequence of returns you experience in your portfolio is more critical once the investment time horizon begins to narrow.

A pitfall to be wary of is processing large withdrawals during a down market in the early Retirement years. While it’s perfectly acceptable to utilize your well-earned savings in Retirement, it would be prudent to pull from liquid investments (savings, money market, cash value from life insurance) at the beginning of the “rocky descent” rather than selling equity exposure.

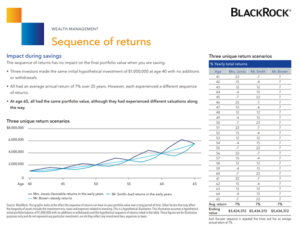

The first picture below shows 3 different investors who:

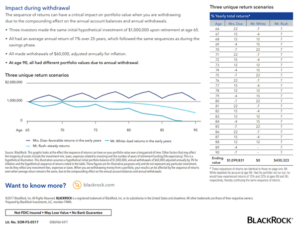

The second example now shows 3 investors who are descending the mountain. These 3 retirees have the following in common:

Why are the results so different now? Because of sequence of return risk.

Because of the sequence of return risk seen clearly here, EWA has put several potential fail safes into place for our retired clients that are actively distributing.

The first one is to help ensure all clients have 7 years of safe money to ensure they are never likely to have to take at an actual loss.

The second one is the “guardrail approach”.

The next step is to help ensure the size of the distribution(s) taken maintains a healthy portfolio.

An important planning topic to become familiar with and monitor is a Retirement Income Guardrail Strategy. “Guardrails” are put in place to monitor the amount withdrawn from your portfolio to help ensure that you are staying within a safe withdrawal rate. Guardrails should be placed at upper and lower bounds to track the amount withdrawn and to help ensure changes are implemented should a barrier be breached. If you’re withdrawing above the upper guardrail, a decrease in spending is appropriate. If you’re withdrawing below the lower guardrail, an increase in spending is prudent if your goal is to maximize retirement income. Guardrails help ensure that you are not spending too much, or to the contrary, underspending your potential in retirement.

The follow-up question tends to be, “how much can one distribute on an annual basis to help ensure the portfolio remains “healthy?”

EWA monitors retirement distributions and their effects on a household portfolio via Monte Carlo Analysis and Withdrawal Rate Analysis.

Monte Carlo Analysis stress tests a portfolio for the likelihood of future success. By running hundreds of variations in asset returns, longevity, inflation rates, and tax rates, Monte Carlo Analysis helps to showcase how a portfolio would fare in ever-changing conditions. It’s important to consistently revisit these stress tests as factors/situations continue to evolve.

Using a standard withdrawal rate percentage primarily ensures a system is in place to monitor portfolio distributions.

There are many opposing viewpoints to the “4% Rule,” but the importance at EWA is to actively manage and have a finger on the pulse of the risk component of the retirement portfolio.

Withdrawal Rate analysis occurs by monitoring the total amount withdrawn on an annual basis vs the total market value of the account(s). Using a 4% baseline with upper and lower guardrails at 3% and 5%, respectively, helps to ensure monitoring and accountability occurs on a consistent basis.

Monitoring withdrawal rates helps to provide warning signs. Think of it as a check-engine indicator in your car. When a warning sign pops up, it’s important to act. At EWA, these warning signs lead to deeper financial planning discussions surrounding your goals and their future likelihood of success.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.

EWA, LLC dba Equilibrium Wealth Advisors, is an SEC-registered investment advisory firm providing investment advisory and financial planning services to clients.

Investments in securities and insurance products are not insured by any state or federal agency.

To view EWA’s public disclosure, registration, Form ADV and Part 2B’s, click here.

To view EWA’s Client Relationship Summary (CRS), click here.

COPYRIGHT 2024 EWA, LLC. ALL RIGHTS RESERVED

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.