In June 2023, a bill that suspended the nation’s debt ceiling was passed by the legislative branch and signed into law by the President– preventing a government default that threatened economic implications for both the United States and the global economy. In this blog, we will explore the details behind the newly signed bill, the United States debt ceiling, and how these changes can impact you and your financial plan moving forward.

What is the “debt ceiling”?

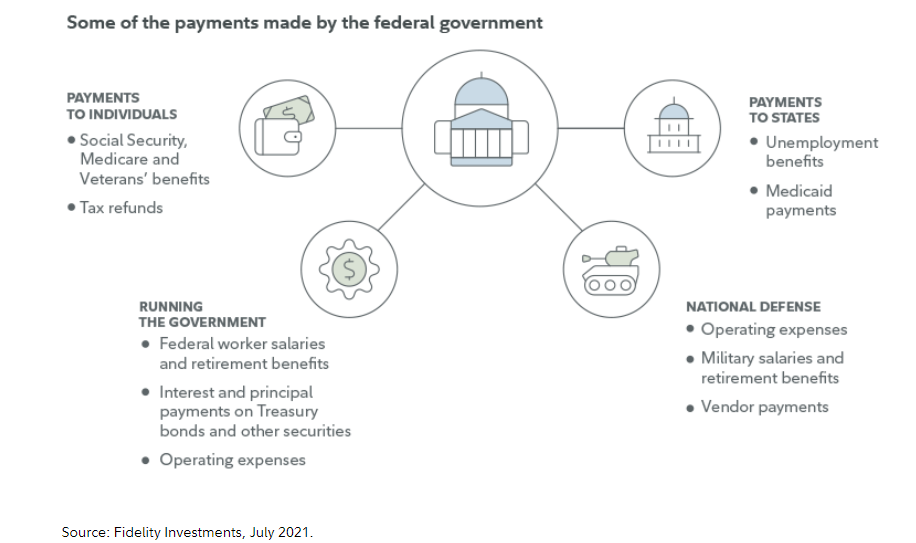

Simply put, the debt ceiling is the maximum amount of money that the United States government can borrow to pay its necessary obligations. These obligations include Social Security and Medicare programs, military spending, payroll for federal employees, and interest on the national debt, among others. The current debt ceiling was reached in January of 2023 at $31.4 Trillion dollars. If the United States exceeds the debt ceiling, they could, in theory, default and fail to pay those detailed obligations.

Has the debt ceiling been an issue in the past, or is this a new development in 2023?

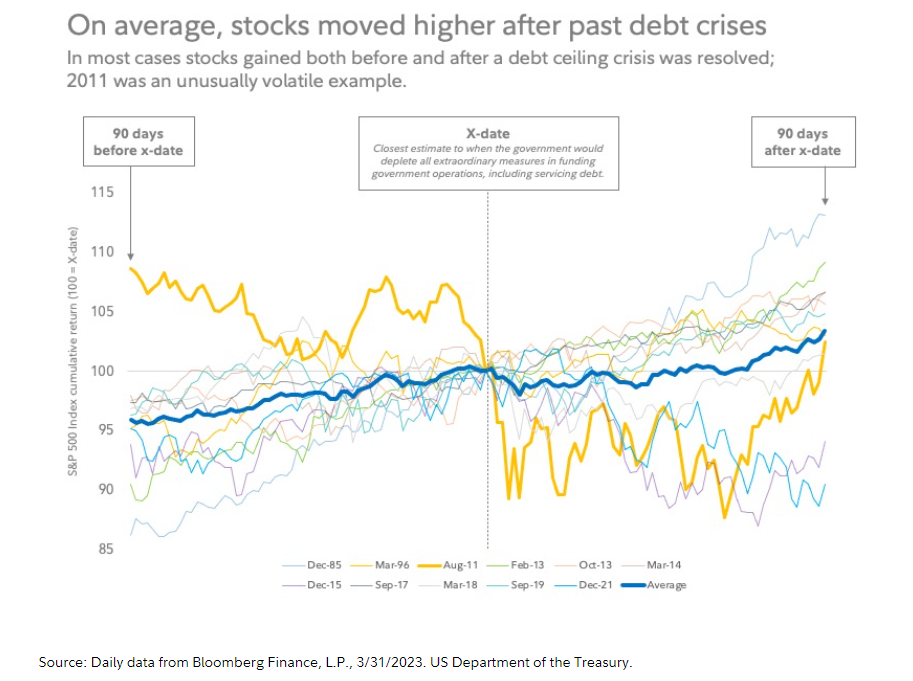

The debt ceiling has been a frequent topic of discussion and consternation for both major political parties. According to the Department of the Treasury, the debt ceiling has been altered or extended 78 different times since 1960. In 2011, discussions around the debt ceiling played a major role in the United States being stripped of its AAA rating by Standard & Poor’s– a rating it had held for nearly a century.

What actions did the government take to avoid a default on the US debt?

The Fiscal Responsibility Act of 2023 was passed in June by a 314-117 vote in the House of Representatives, a 63-36 vote in the Senate, and then signed into law by President Biden. Ultimately, this bill suspended the nation’s debt ceiling until 2025– limiting spending for the next two years in an effort to avoid a default. The Congressional Budget Office estimated the newly signed bill would reduce federal spending deficits by $1.5 Trillion over the next ten years, compared to normal spending had the bill not passed.

Some provisions of the bill include:

Social Security and Medicare programs remained untouched. Additionally, Biden’s student loan forgiveness program and proposed overhaul of income-driven repayment plans were unaffected.

How do the debt ceiling discussions impact my financial plan?

Ultimately, one of the best mindsets an individual investor can have is to only control the controllables. Some actionable steps that we are taking and keeping front of mind at EWA:

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.

EWA, LLC dba Equilibrium Wealth Advisors, is an SEC-registered investment advisory firm providing investment advisory and financial planning services to clients.

Investments in securities and insurance products are not insured by any state or federal agency.

To view EWA’s public disclosure, registration, Form ADV and Part 2B’s, click here.

To view EWA’s Client Relationship Summary (CRS), click here.

COPYRIGHT 2024 EWA, LLC. ALL RIGHTS RESERVED

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.