Written by:

With Pension plans becoming less common and Social Security payments potentially not meeting one’s basic expenses in retirement, many retirees often wonder how to supplement their retirement income to support a sustained lifestyle. From this perspective, an annuity can seem worthwhile to one’s financial plan.

While often discussed as a guaranteed income stream that can participate in the upside of the stock market but without the downside risk, many annuities can have certain pitfalls that make them generally unsuitable for most financial plans. This blog (as a follow-up to the podcast we did on the subject), will seek to explore the different types of annuities available in the marketplace and the issues associated with them.

Simply put, think of an annuity contract as the inverse of a permanent life insurance contract. In a traditional life insurance contract, the insured pays a little bit each month to the insurance company. A beneficiary receives a lump-sum payment from the company at the insured’s death. An annuity works in the exact opposite way. An insured gives a large lump-sum payment to the insurance company, and in return, the insurance company pays the insured an amount back (monthly, semi-annually, or annually depending on the contract).

There are many types of annuities on the marketplace, but the three most common products seen are fixed annuities, index annuities, and variable annuities.

Fixed annuities can either be funded by a single, one-time lump sum or can be considered “deferred”, in which case the annuitant sets a date when the insurance company begins making payments. A few different riders are available to add to fixed annuities, but generally speaking, they provide a fixed, guaranteed payout to the annuitant.

Index annuities are marketed as annuity contracts that can participate in the upside of a specific market index (the S&P 500, for example) while also providing a floor on the contract to protect the contract holder from negative stock market years.

Variable annuities are structured similarly to fixed annuities initially. But instead of providing a fixed, guaranteed payment structure, variable annuities are invested in mutual fund sub-accounts to seek market growth, meaning payments can fluctuate and are not guaranteed.

From the many annuities that have been analyzed, the three most commonly analyzed issues regarding annuities are as follows:

Many annuities, particularly variable and indexed ones, can charge large fees if the annuitant wishes to terminate the contract before a certain period. The sooner the surrender period, oftentimes the higher the charge. These surrender charges can make annuity contracts highly illiquid, meaning there could be a significant stress on one’s financial plan if the annuity needed to be taken out early. For example, in the first year of a variable annuity, the surrender charge could be as high as 7% of the contract’s premium.

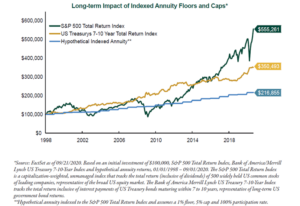

This gripe is specific to index annuities, often sold as having downside protection during a market drop while also participating in upside during risky markets. Generally, index annuities do protect contract holders during down market swings. But there is often a cap on the market growth during market upside. While this is a relief for many retirees, the cap on the market upside can lead to a dramatic difference in overall investment returns. Many index annuities do not consider dividends in their calculations nor allow any of these to be reinvested into the annuity contract itself. This severely hinders the growth of the contract, as reinvested dividends have generally been a key factor in sustained portfolio growth over the long term.

Not only are annuities commissionable products for those who sell them, but they can also be extremely costly from an ongoing fee standpoint. Many variable annuities, for example, charge different types of fees: one for the contract itself, one for each sub-account that the annuity is invested in, and one for any riders added on to the contract (guaranteed income rider, a period certain rider, etc.). Some of the annuities that have been analyzed can charge up to 4% per year, which could eat away at any discussed investment returns.

Let’s assume a client needs to spend $150,000/year to maintain her lifestyle in retirement. Further, let’s assume Social Security pays her $50,000/year and that her fixed costs (utilities, groceries, rent, etc.) total $75,000/year. In this case, there is a $25,000/year gap between Social Security and the client’s fixed costs. A fixed annuity could make sense to help bridge that gap and provide her with a guaranteed income stream to help meet those obligations.

If you are considering an annuity for your financial plan, please be aware of the type of annuity being presented and all the fees and riders associated with that specific contract. If you have an existing annuity and would like it analyzed, please consult with a trusted financial advisory team.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.

EWA, LLC dba Equilibrium Wealth Advisors, is an SEC-registered investment advisory firm providing investment advisory and financial planning services to clients.

Investments in securities and insurance products are not insured by any state or federal agency.

To view EWA’s public disclosure, registration, Form ADV and Part 2B’s, click here.

To view EWA’s Client Relationship Summary (CRS), click here.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.