For many retirees, the transition from a lifetime of saving to a phase of spending can include psychological challenges and strategic dilemmas. This shift is not just about financial readiness but also about psychological adaptation to changes in lifestyle and purpose. A common pattern among retirees, especially those who have been diligent savers throughout their careers, is the difficulty in switching gears from saving to spending. This issue often stems from a deeply ingrained habit of accumulation, which can make the act of drawing down savings in retirement feel counterintuitive or even reckless. This psychological barrier can be so strong that it not only causes stress and anxiety but can also lead to tension between partners and, in worst case scenarios, a significant decrease in life satisfaction during what should be a rewarding phase of life.

The crux of retirement planning isn’t simply about how much you’ve saved—it’s also about how you plan to spend those savings without the fear of running out. Here are some common strategies and their adaptations:

Originally derived from historical market data, the 4% rule suggests that retirees can withdraw 4% of their retirement portfolio annually, adjusted for inflation, with a reasonable expectation that their funds will last through 30 years of retirement. However, potential market volatility and longer life expectancies have led to recent questions about whether this percentage is still valid, with some experts suggesting a more conservative approach.

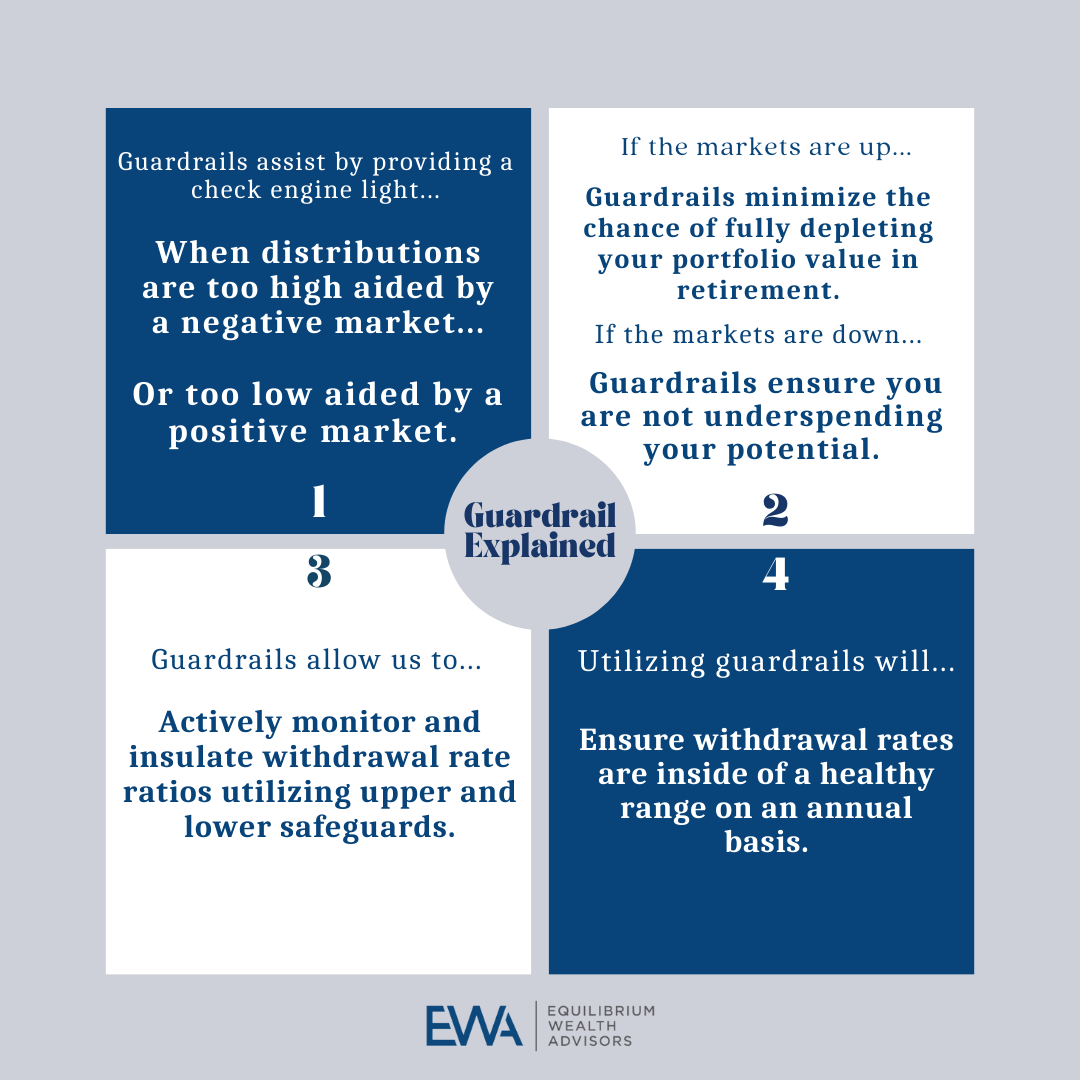

Rather than sticking to a rigid withdrawal rate, some financial planners recommend a more flexible approach that adjusts spending based on market performance and personal circumstances. The “guardrails” strategy is a popular method where spending limits are adjusted annually to reflect the current economic environment and portfolio performance.

This approach involves dividing retirement savings into different “buckets” for various stages of retirement or for different spending purposes (e.g., daily living expenses, travel, healthcare). Each bucket can be invested differently based on when the funds will be needed, providing a structured yet flexible spending plan

While often debated, annuities could be a part of the retirement portfolio for those seeking guaranteed income. Fixed annuities can provide a steady income stream, complementing other retirement funds and Social Security benefits. However, the key is to ensure that annuities are used judiciously, as they can also be restrictive, and many come with high fees.

One of the most significant tasks for financial advisors working with retirees is helping them overcome the fear of spending their savings. This often involves regular discussions about the purpose of their accumulated wealth and encouraging clients to enjoy the fruits of their life’s work. For many retirees, giving themselves permission to spend can be assisted through regular financial reviews with their financial advisor in which spending plans may be adjusted. This can provide additional assurance that retirees that they are on the right track. Also, maintaining clear and honest communication with loved ones and trusted advisors can help alleviate worries about legacy and inheritance issues. Lastly, building a savings plan before beginning to spend can help ensure the plan matches the retirees’ lifestyle and goals.

The journey into retirement should be as meticulously planned as one’s career. With the right guidance, retirees can overcome the psychological challenges and strategic complexities of turning their savings into a sustainable income. This helps ensure not just financial security, but also the prospective fulfillment that most seek in retirement.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.

EWA, LLC dba Equilibrium Wealth Advisors, is an SEC-registered investment advisory firm providing investment advisory and financial planning services to clients.

Investments in securities and insurance products are not insured by any state or federal agency.

To view EWA’s public disclosure, registration, Form ADV and Part 2B’s, click here.

To view EWA’s Client Relationship Summary (CRS), click here.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.