The annual inflation rate in the United States has hit a decade-long high of 8.2%. While households may be feeling the impacts of this in their day-to-day lives, there are some positives to note. Looking ahead in 2023, households may see increased tax savings after certain credits and deductions have been significantly increased. In the same light, there are increased retirement savings opportunities.

New Tax Brackets for 2023

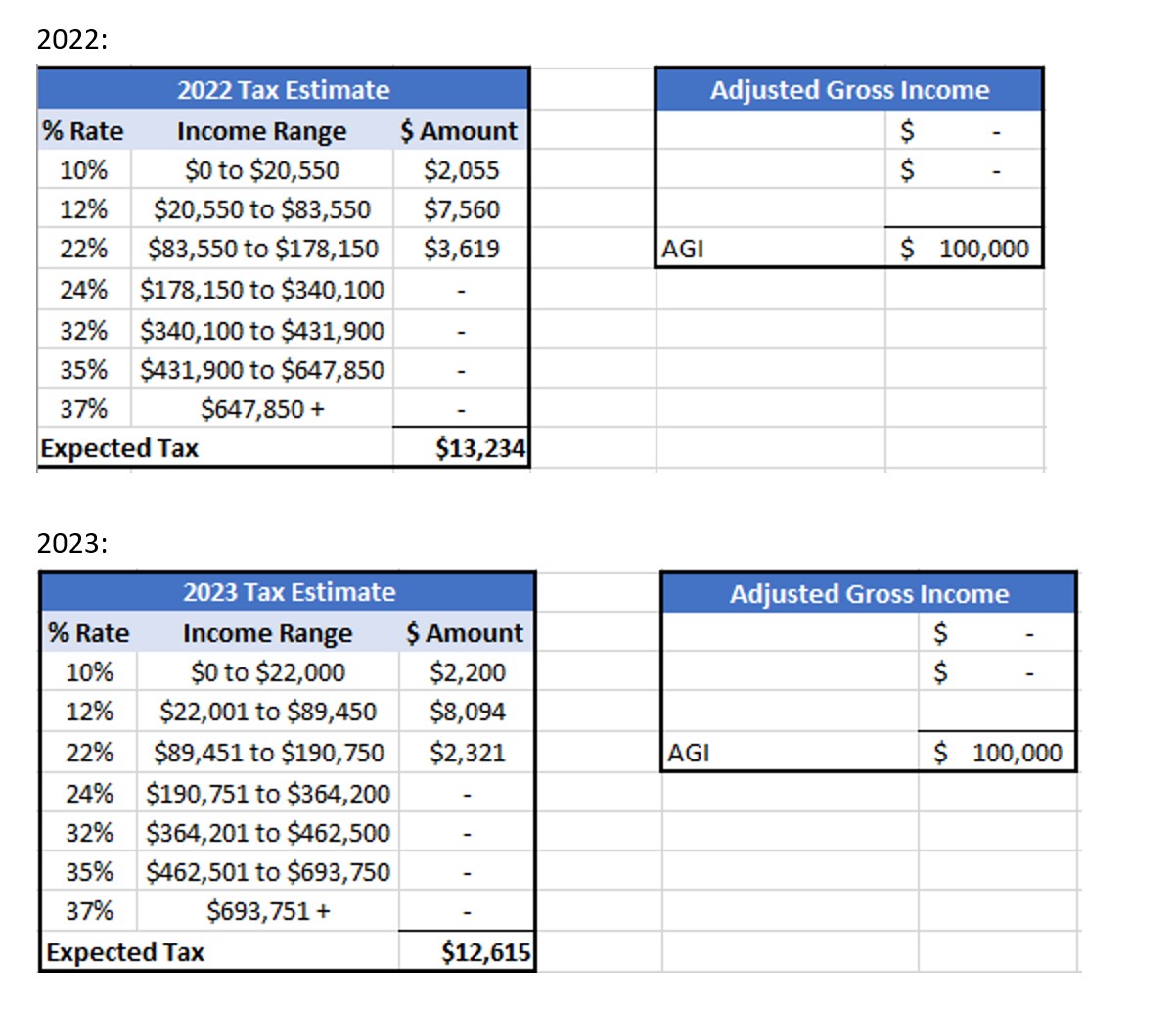

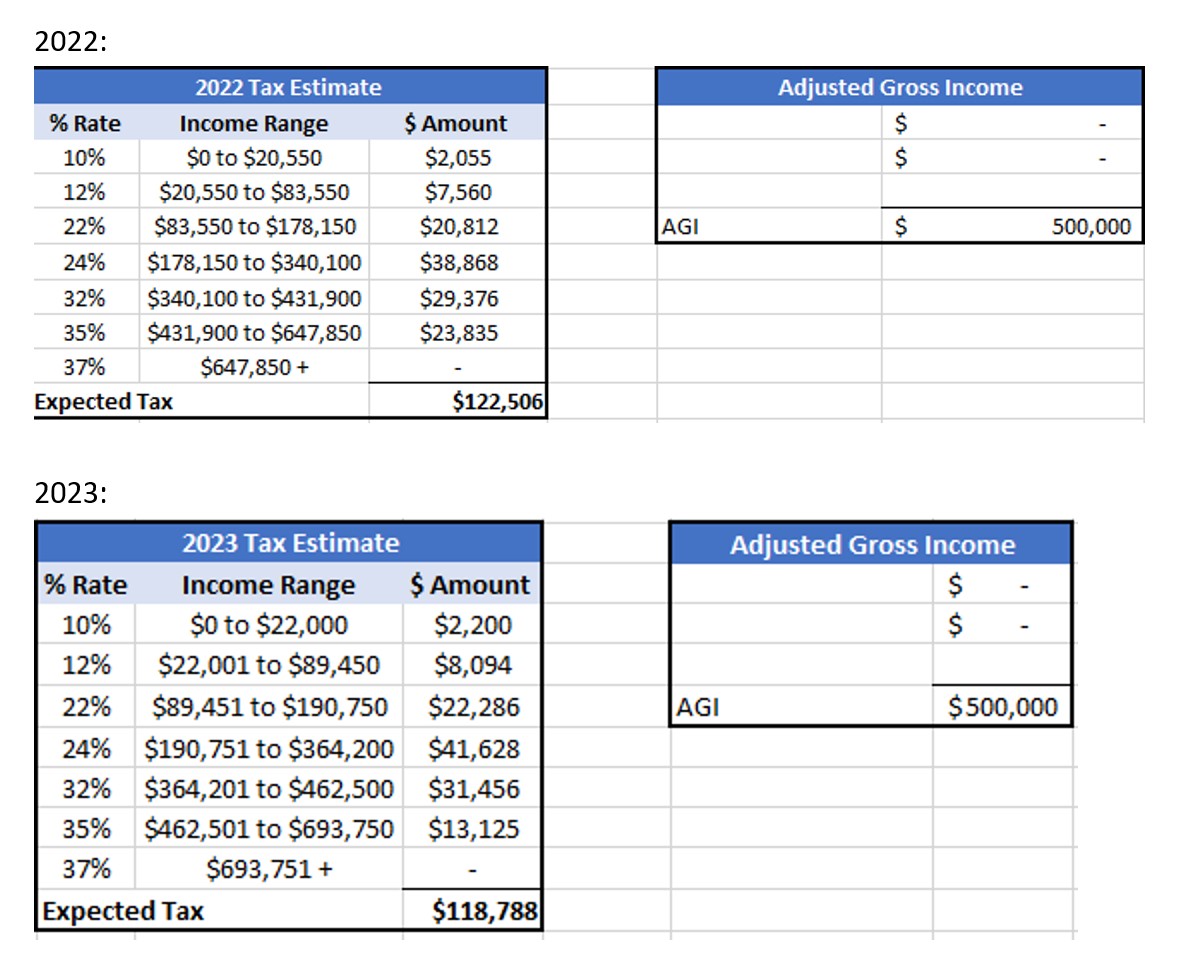

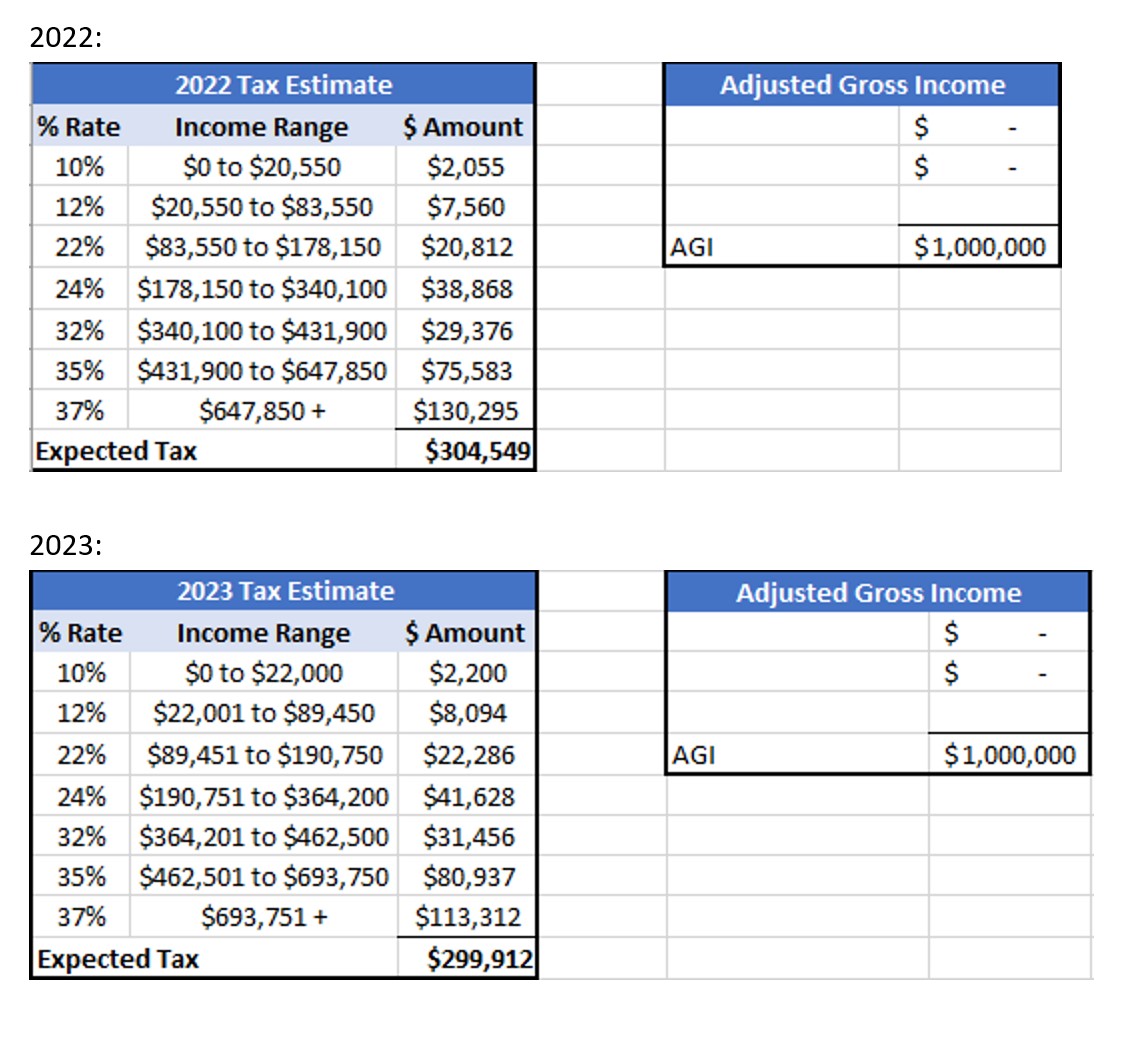

The IRS has adjusted the income limits associated with marginal tax rates to account for increased inflation in 2023. The United States tax system is progressive– the first $20,550 of income is taxed at 10%, income up to $83,550 is taxed at 12%, moving all the way up the brackets until $647,850 of income and above taxed at 37% (assuming married filing jointly). In 2023, the 37% tax bracket will increase from $647,850 to $693,751.

As a result—expect to see a little bit more in your paycheck as each bracket has increased, meaning more income will be taxed at lower rates as you climb through the brackets.

A household, married filing jointly earning $100,000, will expect to see a $600 federal tax savings in 2023

A household, married filing jointly earning $500,000, will expect to see a ~3,700 federal tax savings in 2023

A household, married filing jointly earning $1M, will expect to see a ~$4,600 federal tax savings in 2023

Increased Standard Deduction Limits for 2023

To calculate one’s taxable income, one must first take their gross income (ex: wages, salaries, capital gains) and subtract any above-the-line deductions (ex: Traditional IRA contributions, pre-tax 401(k) contributions) to determine their adjusted gross income (AGI). Once AGI is finalized, one can either take the standard deduction or the sum of their itemized deductions– whichever is greater. For most, the standard deduction results in the larger tax savings– and that limit is being increased for 2023. For single filers, the standard deduction is jumping from $12,950 to $13,850 (a $900 increase). For those married filing jointly, the deduction increases even further from $25,900 to $27,700 (an $1,800 increase).

Increased Annual Gifting Limits for 2023

For those who are implementing a gifting strategy during their lifetime, the annual exclusion for gifts will increase from $16,000 to $17,000 per year. With this increased limit, an individual can give $17,000 to an individual without having to file a Form 709 to the IRS, or have it count against your lifetime gift exemption. For example, let’s assume two spouses have three children and want to maximize their intrafamily lifetime gifting strategy for 2023. The two spouses can elect to “split gift” and combine their two $17,000 limits ($34,000 total) to each of their three children. This results in a $102,000 transfer ($34,000 gift to each of their three children) that now avoids a 40% estate tax upon death– a $40,800 estate tax savings each year if the household is over the lifetime gift exemption (set to increase to $12,920,000 from $12,060,000 in 2023). *Note that this lifetime exemption is set to decrease by approximately half in 2026, unless legislation changes.

Increased 401(k) and IRA Limits for 2023

The 402(g) limit, or amount that one can defer from his/her salary to a 401(k) plan will increase from $20,500 to $22,500 in 2023. Likewise, IRA contributions (both Traditional and Roth) will increase from $6,000 to $6,500. These cost-of-living adjustments help ensure that retirement savings are keeping up with inflation.

Other items to note moving forward into 2023:

__________________________________________________________________________________

Equilibrium Wealth Advisors is a registered investment advisor. The contents of this article are for educational purposes only and do not represent investment advice.

Stock markets are volatile, and the prices of equity securities fluctuate based on changes in a company’s financial condition and overall market and economic conditions. Although common stocks have historically generated higher average total returns than fixed-income securities over the long-term, common stocks also have experienced significantly more volatility in those returns and, in certain periods, have significantly underperformed relative to fixed-income securities. An adverse event, such as an unfavorable earnings report, may depress the value of a particular common stock held by the Fund. A common stock may also decline due to factors which affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.

Past performance is no guarantee of future results. The change in investment value reflects the appreciation or depreciation due to price changes, plus any distributions and income earned during the report period, less any transaction costs, sales charges, or fees. Gain/loss and holding period information may not reflect adjustments required for tax reporting purposes. You should verify such information when calculating reportable gain or loss.

This content has been prepared for general information purposes only and is intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an offer, invitation, investment advice or inducement to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any matter contained in this document. The tax and estate planning information provided is general in nature. It is provided for informational purposes only and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Contents for information purposes only and nothing herein shall constitute an offer to buy or sell securities, nor does it amount to tax, legal or investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.