Written by:

In recent years, the Mega Backdoor Roth strategy has gained popularity among high-income earners seeking to maximize their retirement savings. This advanced financial planning tactic allows participants in certain 401(k) plans to make sizable after-tax contributions and convert them to their Roth 401(k), potentially creating a powerful tax-free growth vehicle. However, Allegheny Health Network has recently implemented changes to its after-tax contribution limits, altering how employees can take advantage of this strategy.

In this post, we’ll break down what the Mega Backdoor Roth is, what the new changes entail, and what it means for employees and medical professionals who’ve been leveraging this approach—or planning to. Whether you’re a seasoned participant or just exploring your retirement options, understanding these updates is key to making the most of your employer-sponsored plan.

First, it is important to understand how the Mega Backdoor Roth strategy works. The key figure to keep in mind when executing this strategy is the 415(c) limit for retirement plan contributions, or the total amount that can be contributed to a qualified retirement plan in a given calendar year. In 2025 for those under the age of 50, that limit is $70,000. Meaning, between your salary deferral, employer match, and after-tax contributions, you can contribute up to $70,000 into your 401k or 403b in a calendar year.

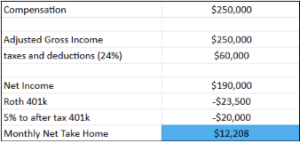

Specifically for AHN employees, let’s walk through a few examples to see how this would look in practice. Let’s assume an AHN employee is earning $250,000 of compensation. To fully maximize their contributions, they can first look to contribute the maximum salary deferral, or 402(g) limit of $23,500, to their pre tax or Roth 401(k). In this instance, we’ll assume all $23,500 is contributed to their Roth 401(k), as Roth plans have a variety of tax efficiencies and advantages. They’ll also receive their employer match from AHN of 4% (only on their first $350,000 of compensation), plus a 1% annual contribution as well. So far, this person has $23,500 from their deferral + $12,500 from AHN’s match.

The big change, beginning June 6th, 2025, is that AHN is increasing the after-tax percentage contribution for employees from 5% to 8%. Meaning, employees can now get more money into their after-tax 401k, increasing the amount they can convert to their Roth 401k to finalize the MegaBackdoor Roth strategy. The employee above making $250,000 can now get an additional $20,000 in after-tax contributions added to their 401k each year.

Between $23,500 worth of deferrals, $12,500 of AHN match, and $20,000 of after-tax contributions, this person is now contributing $56,000 to their 401k, with the majority of these contributions being Roth dollars, which grow and distribute income tax free.

Breaking down how this would appear on a monthly cash flow basis, the $250,000 employee would realistically look at netting ~$12,000/month after taxes and retirement plan contributions if they implement this strategy to the fullest extent:

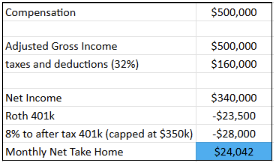

Let’s break down another example, but this time the employee is earning $500,000 instead of $250,000. The MegaBackdoor Roth plan begins the same way: $23,500 worth of deferrals to the Roth 401k. The change we need to be aware of from the first example is that the employer match from AHN is only based on the first $350,000 of compensation, which is 2025’s maximum includible compensation limit posted by the IRS. So, the employee would receive a 5% match on $350,000, not $500,000. With this in mind, the AHN match they’d receive is $17,500. Now beginning in June 2025, they can contribute 8% to their after-tax 401k (again, an increase from the previous 5% limit).

An 8% after-tax contribution (capped at the IRS limit’s first $350,000 of compensation) is an additional $28,000 that this person could get into their 401k plan on an annual basis, before converting to their Roth 401k to finalize the MegaBackdoor Roth strategy.

This person’s $23,500 deferral plus $17,500 match plus $28,000 after-tax contribution means they can contribute $69,000 annually to their plan. In practice, this person would be netting ~$24,000/month after taxes and contributions if they fully implemented this plan:

In summary, this is a positive development for AHN employees. In the state of Pennsylvania, money held inside of a 401(k) is asset protected in the event of a lawsuit– making the 401(k) one of the best places to accumulate wealth for the long-term. Additionally, since a large majority of these contributions would be Roth deferrals or converted Roth money, there would not be any ordinary income tax on any growth of these funds nor distribution of these funds in the future.

If you have any questions about how your AHN 401(k) plan is currently structured, or how these new changes impact you specifically, please reach out to a trusted tax or financial advisor to help consider all available options.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Contents for information purposes only and nothing herein shall constitute an offer to buy or sell securities, nor does it amount to tax, legal or investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.