Written by:

Having a sound investment strategy is crucial to giving an investor greater peace of mind, rather than relying solely on investment returns when making life decisions. At EWA, we follow 4 main investment pillars that help allow our clients to live life by design, rather than default, and make life choices without relying entirely on market returns. These 4 concepts are asset allocation, diversification, long term investing, and asset location.

1st Pillar: Asset Allocation:

Asset allocation is the act of investing in different categories of investments, called asset classes. If you’re a football fan, this is like having the correct player at each position on the field. Rather than having the quarterback on the field alone, you want a running back, a wide receiver, tight end, etc. all on the field to build a well-rounded offense. The same concept applies to an investment strategy, it is important to have multiple asset classes present to form a well-rounded portfolio. Generally, we see one of two scenarios:

To be in scenario 2, limiting downside risk is very important, which can be managed through proper asset allocation. An example would be if parts of the market are down when your kid is going to college or you are in retirement, it is crucial that you have a portion of your portfolio that can be taken out at a gain.

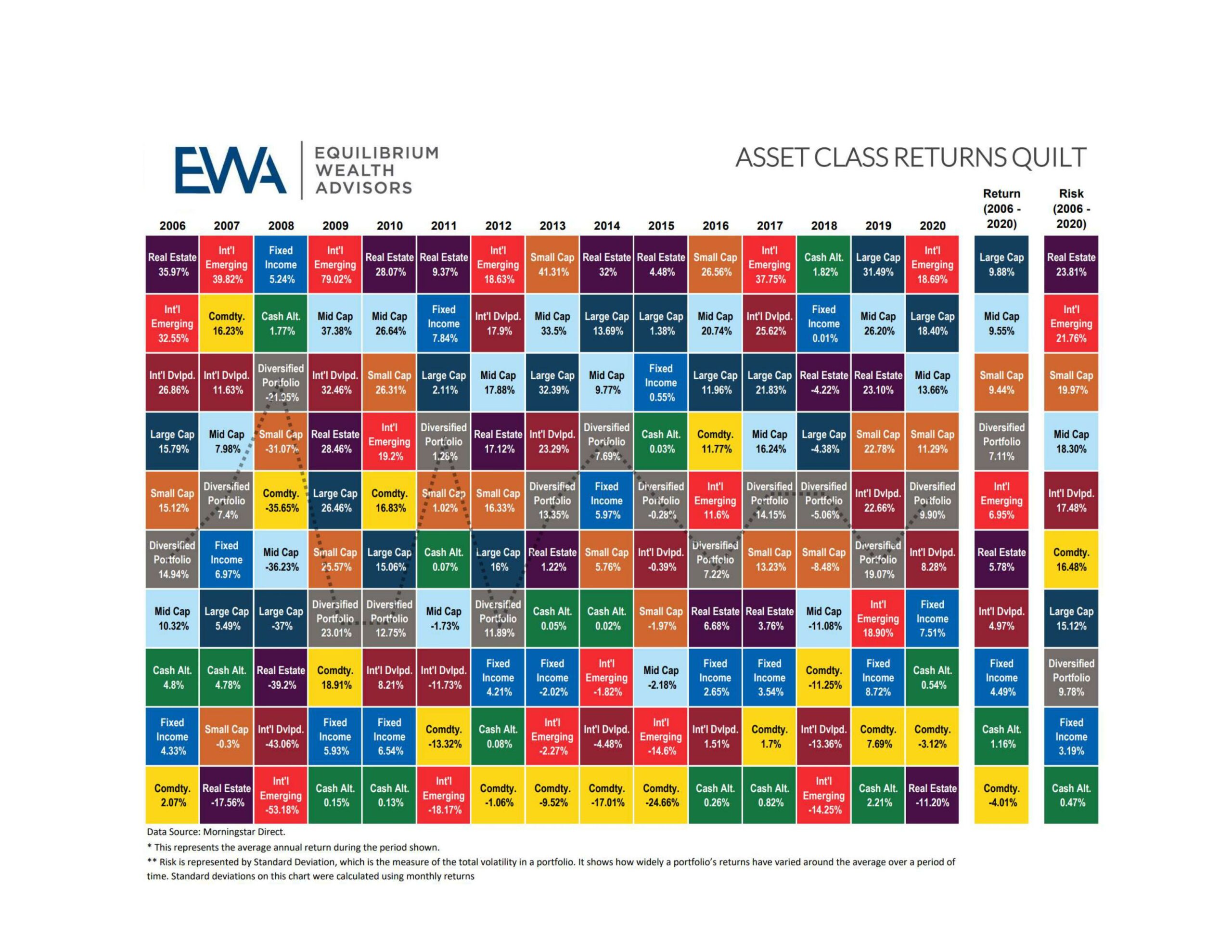

This chart below shows several asset class investments you could have made from 2006-2020:

The gray box shows what an asset allocated portfolio invested in all 9 asset classes with a mix of 60% equity/ 40% fixed income. This trends right in the middle, and over 15 years, has been between 6-7% return, and risk has historically been low.

Asset allocation increases the likelihood that some portion of the portfolio will maintain positive returns to support the possible need for a withdrawal without selling other positions at a loss. For example, in 2008, most equity asset classes returned negative. If you were in a 60/40 asset allocation portfolio as shown above, you would have had 40% of your portfolio in fixed income that you could have sold at a gain to avoid selling any losses if withdrawals were needed.

2nd pillar: Diversification:

The next concept we recommend following is diversification. Diversification refers to the process of having an assortment of investments within each asset class. Using the same football analogy, not having a diversified portfolio is like having a starting lineup with no backups. You would be in trouble if your quarterback got hurt. The same concept applies to diversification. If you have 25 investments within an asset class, that reduces diversification risk. And if you can have 100 investments in an asset class, that further reduces diversification risk. This is diversification and is intended to illustrate the importance of investing in different investments within each asset class, so you have a variety, where if some investments go down, others will hopefully maintain or gain value, thereby offsetting negative long-term effects to a portfolio.

The easiest way to explain diversification is by trying to break a pencil. Try to break 1 pencil and it is easy to snap it in half. Try to break 100 pencils wrapped in a bundle using a rubber band, and it would be nearly impossible. This is asset class diversification.

Many of the ETFs/mutual funds that we recommend to clients have 100+ underlying investments within the fund to make sure they are properly diversified. The stock market historically goes up and down, but over long periods of time has tended to trend up.

3rd Pillar: Long Term investing

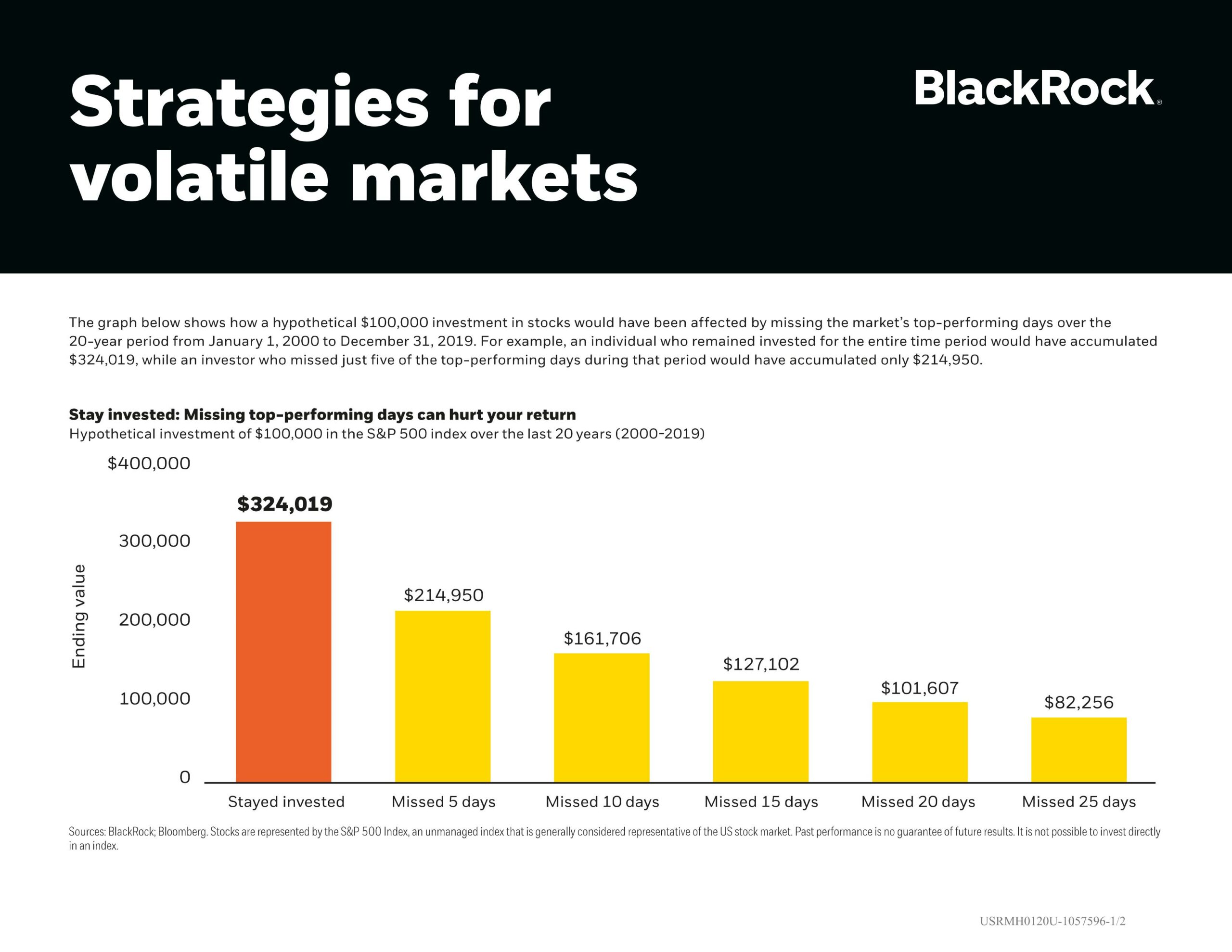

There was a study done by DALBAR, a financial research firm, that showed how the general temptation for investors to try and time the stock market often resulted in the investor diving into the market at the top and fleeing at the bottom. This chart shows this mistake monetized:

This is showing an investor that invests $100,000 on January 1st, 2000, into the S&P 500. The orange box shows that if they stayed invested every day until December 31st, 2019, their account would have grown to $324,019. The yellow box to the right shows the same investor, but they hypothetically pulled out of the market on the top 5 performing days in that same period. Their account is only $214,950 after missing the 5 best days. Their account is at a loss if they miss just the best 25 days out of 20 years with an ending balance of $82,256.

4th Pillar: Asset Location

The fourth concept we follow is asset location (different from asset allocation). Asset location is a tax efficient investment strategy that refers to how investments are distributed between various accounts, such as taxable accounts, tax-deferred or tax-free accounts. Sticking with the football analogy again, a quarterback is generally better suited to play on offense rather than defense. The same applies to an investment strategy. Tax efficient investments are well suited for use inside of a taxable account, whereas less tax efficient investments may be more appropriate to be placed inside an IRA where no taxes are paid while the account grows.

Instead of viewing each account you have as separate entities that should have the same asset allocation mix, it may be beneficial to view everything as one entity and reverse engineer which accounts hold each asset class. Decide on asset allocation and diversification mix-up first, and then allocate positions where they are best suited for tax efficiency. Example would be keeping corporate bonds outside of your taxable account, but okay to keep them inside your IRA (since they pay interest that is taxed at marginal tax rates). The most aggressive growth asset classes should be placed in your Roth IRA where all growth and distributions are tax free assuming the 5-year rule (if converted or rolled into a Roth), and age of 59 ½ has been reached.

Having a sound investment strategy and principles to stick to when times in the market get hard will help live life by design, rather than worrying about what the market does or does not do when making decisions.

_______________________________________________________________________________

Equilibrium Wealth Advisors is a registered investment advisor. The contents of this article are for educational purposes only and do not represent investment advice.

Stock markets are volatile, and the prices of equity securities fluctuate based on changes in a company’s financial condition and overall market and economic conditions. Although common stocks have historically generated higher average total returns than fixed-income securities over the long-term, common stocks also have experienced significantly more volatility in those returns and, in certain periods, have significantly underperformed relative to fixed-income securities. An adverse event, such as an unfavorable earnings report, may depress the value of a particular common stock held by the Fund. A common stock may also decline due to factors which affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. For dividend-paying stocks, dividends are not guaranteed and may decrease without notice.

Past performance is no guarantee of future results. The change in investment value reflects the appreciation or depreciation due to price changes, plus any distributions and income earned during the report period, less any transaction costs, sales charges, or fees. Gain/loss and holding period information may not reflect adjustments required for tax reporting purposes. You should verify such information when calculating reportable gain or loss.

This content has been prepared for general information purposes only and is intended to provide a summary of the subject matter covered. It does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of issue and may change over time. This is not an offer document, and does not constitute an offer, invitation, investment advice or inducement to distribute or purchase securities, shares, units or other interests or to enter into an investment agreement. No person should rely on the content and/or act on the basis of any matter contained in this document. The tax and estate planning information provided is general in nature. It is provided for informational purposes only and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

In just 15 minutes we can get to know your situation, then connect you with an advisor committed to helping you pursue true wealth.

Add me to the weekly newsletter to say informed of current events that could impact my investment portfolio.

Important Disclosures:

Securities and advisory services offered through EWA LLC dba Equilibrium Wealth Advisors (a SEC Registered Investment Advisor).

* Contents for information purposes only and nothing herein shall constitute an offer to buy or sell securities, nor does it amount to tax, legal or investment advice.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

In 15 minutes we can get to know you – your situation, goals and needs – then connect you with an advisor committed to helping you pursue true wealth.